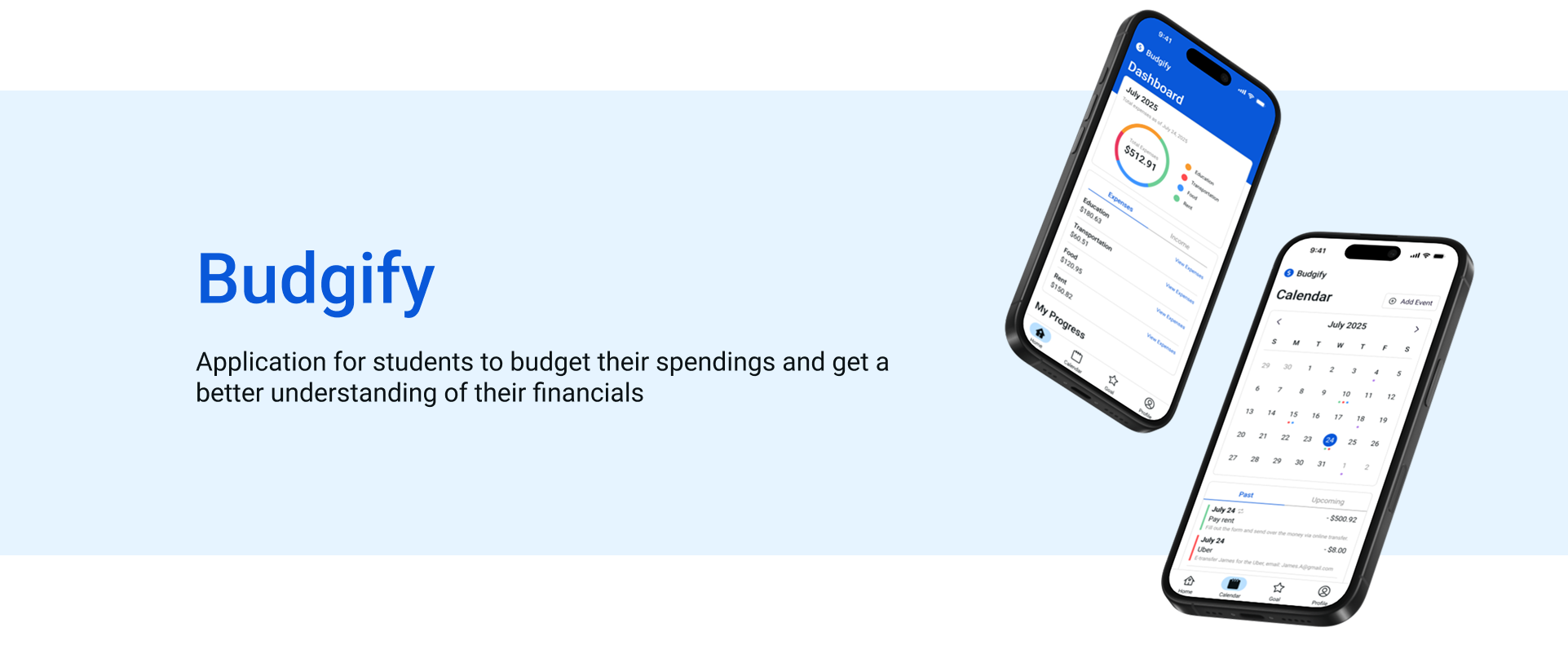

Project Overview

- Discover & Empathize

- Define

- Ideate

- Design

- Key Takeaway

Discover & Empathize

Students have a lot of financial concerns and here are just a few that we thought of: rent, tuition fees, food, extracurricular memberships, textbooks and so on... which results in questions like...

- When is my rent due?

- Did I pay my membership fee?

- How much of this month’s budget do I have left?

- How can I make my spendings more efficient?

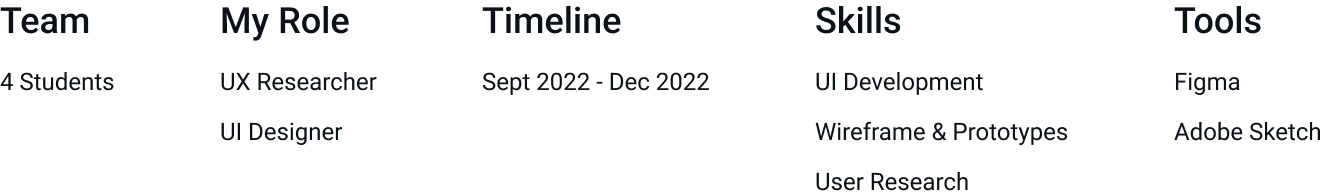

These are the following statistics from TD Bank Group

By helping students build a better relationship with money, we can give them the confidence to manage it well, develop good habits, and make lasting improvements in their lives.

Research Method

Our team distributed a questionnaire to 7 post-secondary students currently studying in Ontario, ranging from first-year to fifth-year students.

The goal was to gain deeper insight into how students perceive and manage their finances. By including students at different stages of their academic journey, we aimed to understand their financial knowledge and the strategies they use to budget while in school.

Empathy Interviews

Based off of the questionnaire responses, our team determined two main commonalities:

-

Students have difficulty keeping track and organizing their financials.

It gets a bit overwhelming sometimes to keep track of my budget. On top of my school work, I have to remember to pay for rent, my tuition, buy groceries and more. I sometimes pay my fees too late and have to pay an extra fee. I want to know where I am spending my money.

- Third-year student at York University

-

Students find it challenging to maintain motivation for saving money.

There are so many instances where I spend money and realize that the purchase was not necessary. I want to be able to know how much I have budgeted for the month, and how much I am able to spend.

- First-year student at York University

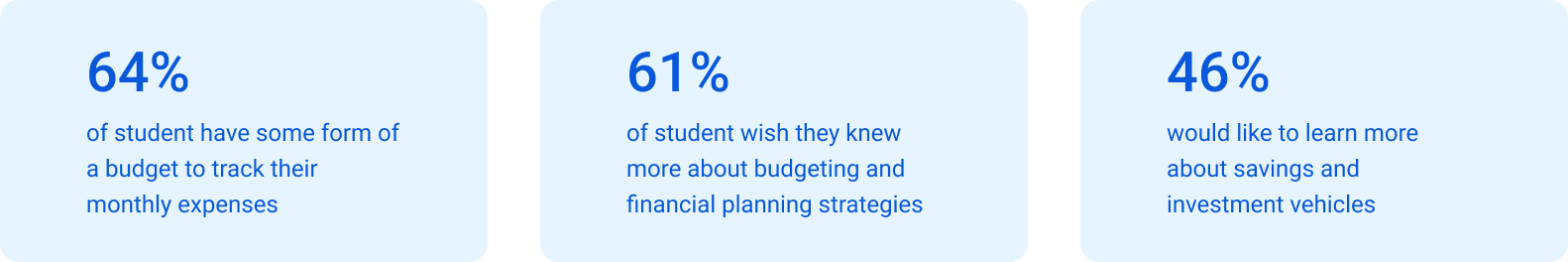

User Persona

From looking at the interview responses, we were able to analyze and come up with a user persona. The user persona helps us get a better understanding of the needs of students from their perspective, and get a clearer idea on the problem we want to tackle.

Define

The 5 Ws and H

We can use the 5 Ws and H to further understand and empathize with the user regarding the problem that is hoping to be solved. We used Elizabeth, our user persona, to help empathize with the users.

Who: A busy student.

What: Elizabeth wants to save more money and find a better way to track and organize her finances.

When: Elizabeth would use the app ocassionally, potentially every couple of days.

Where: Elizabeth would be able to use the app anywhehere.

Why: As a student, Elizabeth does not keep all of her finances in one place on her phone, and so she gets frustrated whenever she has to figure out her financial status.

How: Understanding their budgeting and saving journey helps map how they set goals, track expenses, and adjust habits over time.

Problem Statement

We can now define a problem statement for Elizabeth, helping clarify the users' goals and any potential constraints.

Elizabeth is a busy student who needs a quick and simple mobile app to track her spending because she doesn’t have time to prioritize budgeting every day

Defining the Problem

From the interview insights and creating the persona, we were able to have a clear idea of the problem we wanted to tackle:

Students not being able to organize and budget their finances in a simple and easy manner.

We aimed to design an app that helps students easily manage finances, save time, and reduce the stress of manual tracking, while promoting smart spending and saving habits.

Ideate

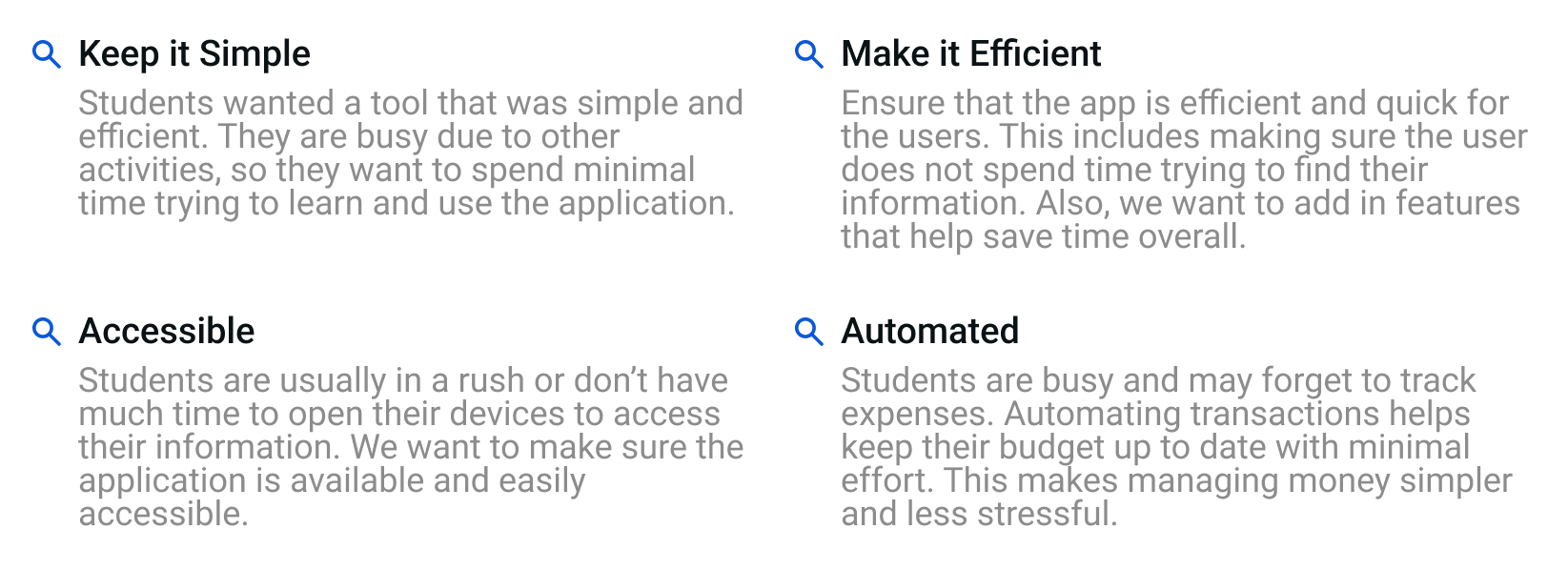

How Might We

Now that we were able to figure out the problem we wanted to solve for our users, we came up with our How Might We statements

- How might we make the application simple enough for all students, regardless of their experience with mobile applications?

- How might we make it effecient for students, such that they are able to access their financial status quickly and with as little problem as possible?

- How might we make the student's financial information as accesible as possible?

- How might we automate and simplify the process for students to securely link their bank accounts to the app?

Design Requirements

We want to create an app that helps manage students’ budgets while keeping them motivated to manage their money. What should we consider when building this application? What are the needs required for the application to tackle our problem while making it favorable for students to use?

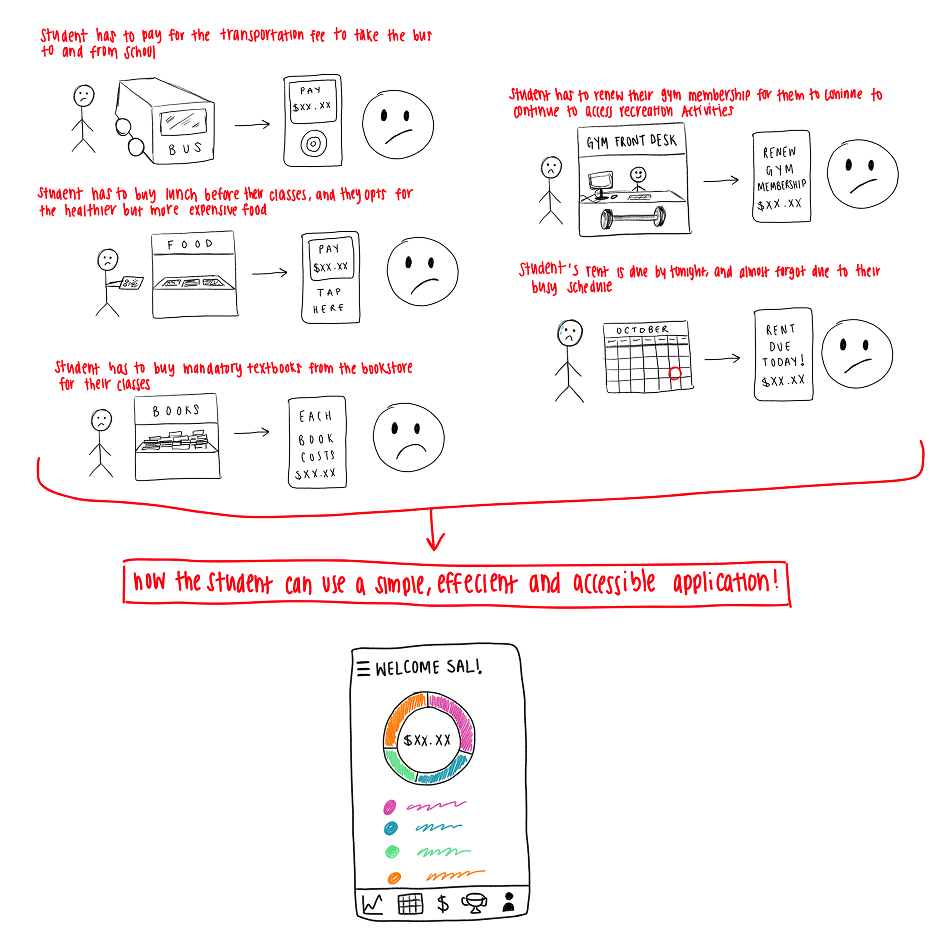

Sketching A Scenario

In order to get a better understanding of how the students will use the application during their day-to-day lives, we wanted to sketch out a scenario.

This scenario was created with the combination of information from the user interview, user persona, understanding the problem and design requirements

I sketched out the scenario using Adobe Sketch. I wanted to emphasize the main scenarios that would be relevant to a student in their day-to-day lives, and how it can be simplified with a potential application.

Note: The application in the sketch is a very rough outline of what the application is, not what it could look like. It is a placeholder.

Potential Solutions

The following are solutions to the design requirements and the highlighted problems:

-

Is a mobile application

Students are most likely to use the application on a mobile device. We want to make sure that the application can be opened on a mobile device, fits the screen, and has features that are reflective of that.

-

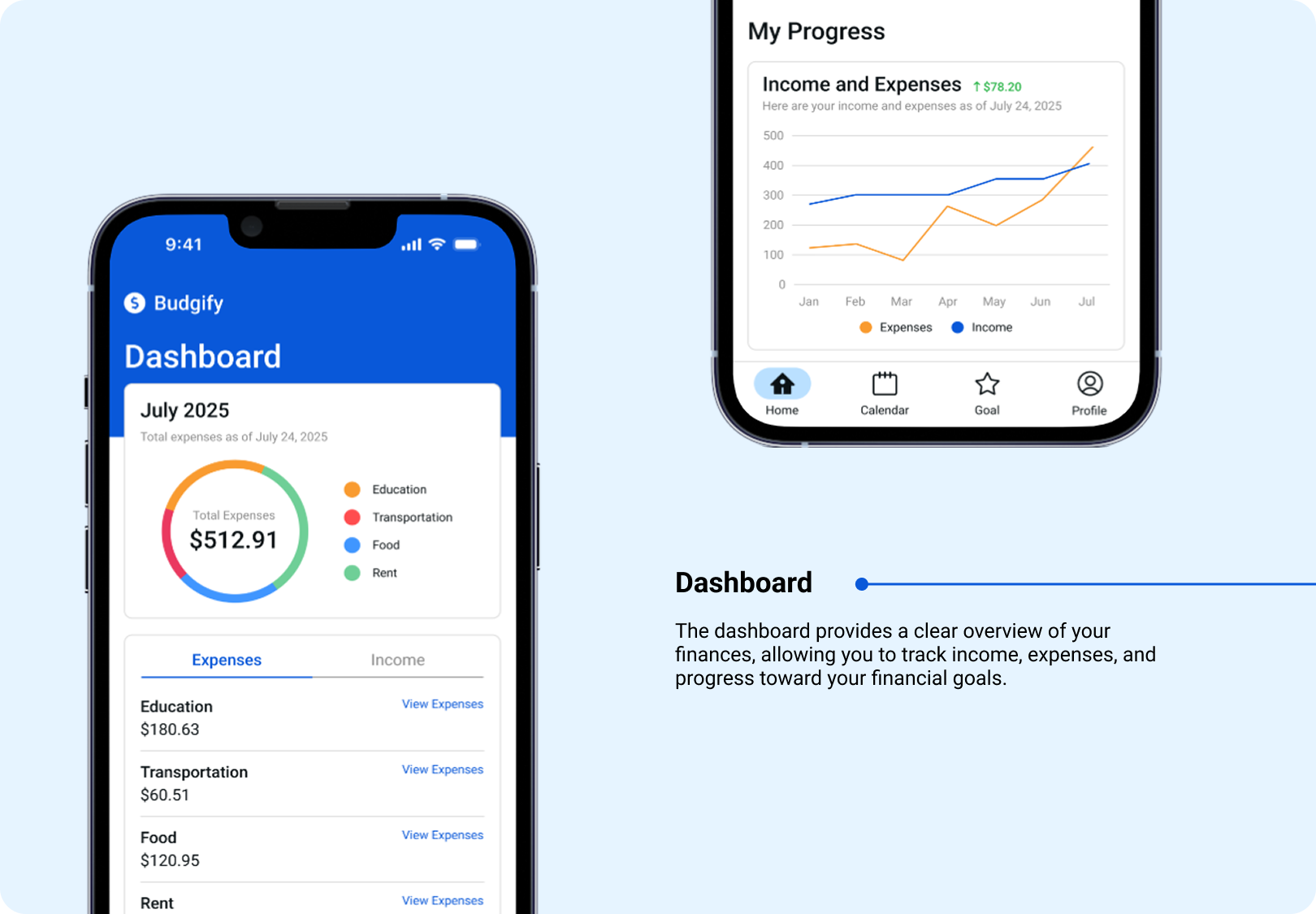

Display user's summary

Summary of the user s financial information. We want to making sure this feature is simple and easy for the user to access.

-

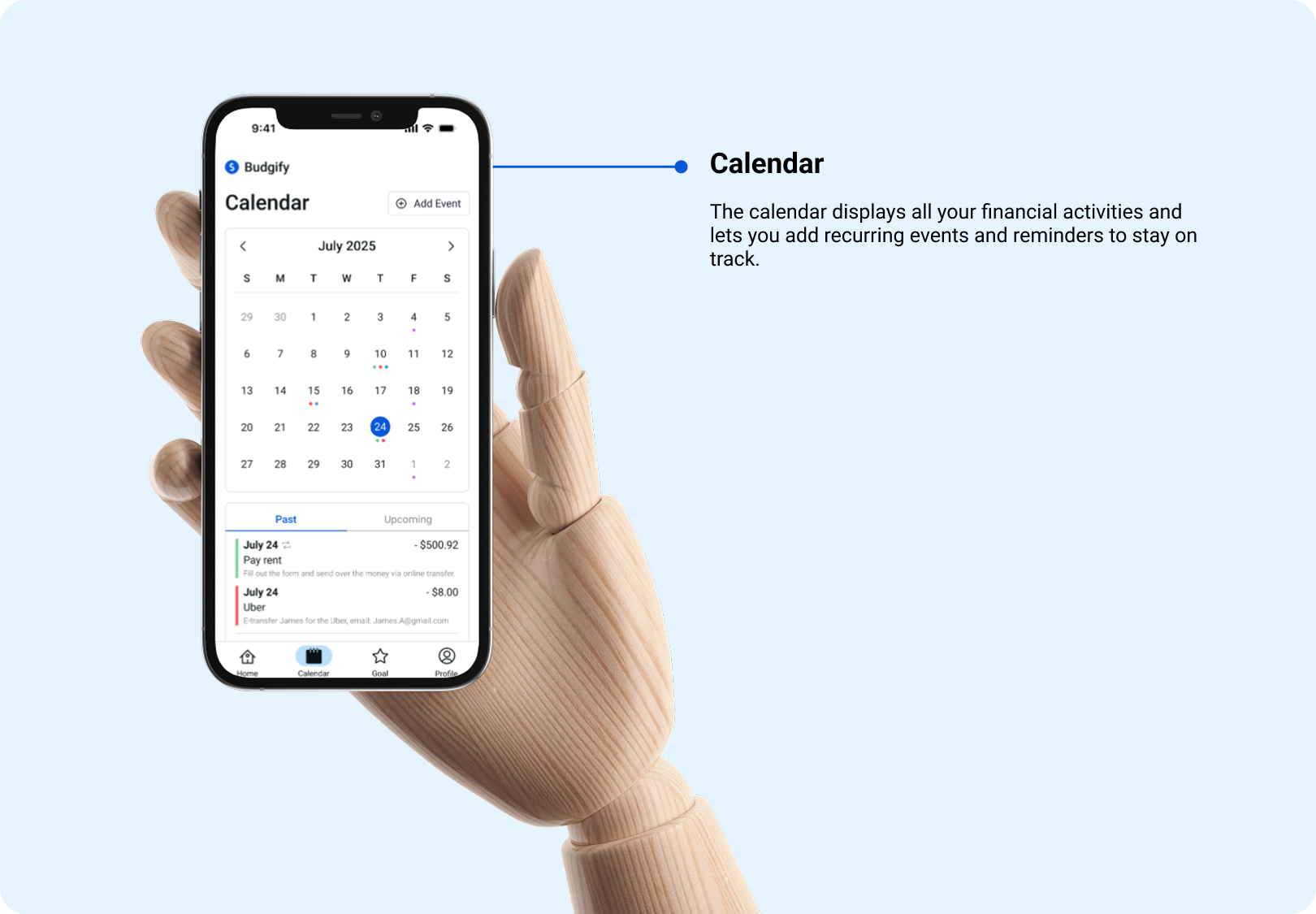

Calendar

A calendar to display the user’s finances each day of the month helps remind the user about any important upcoming dates and shows how their money was budgeted over a period of time.

-

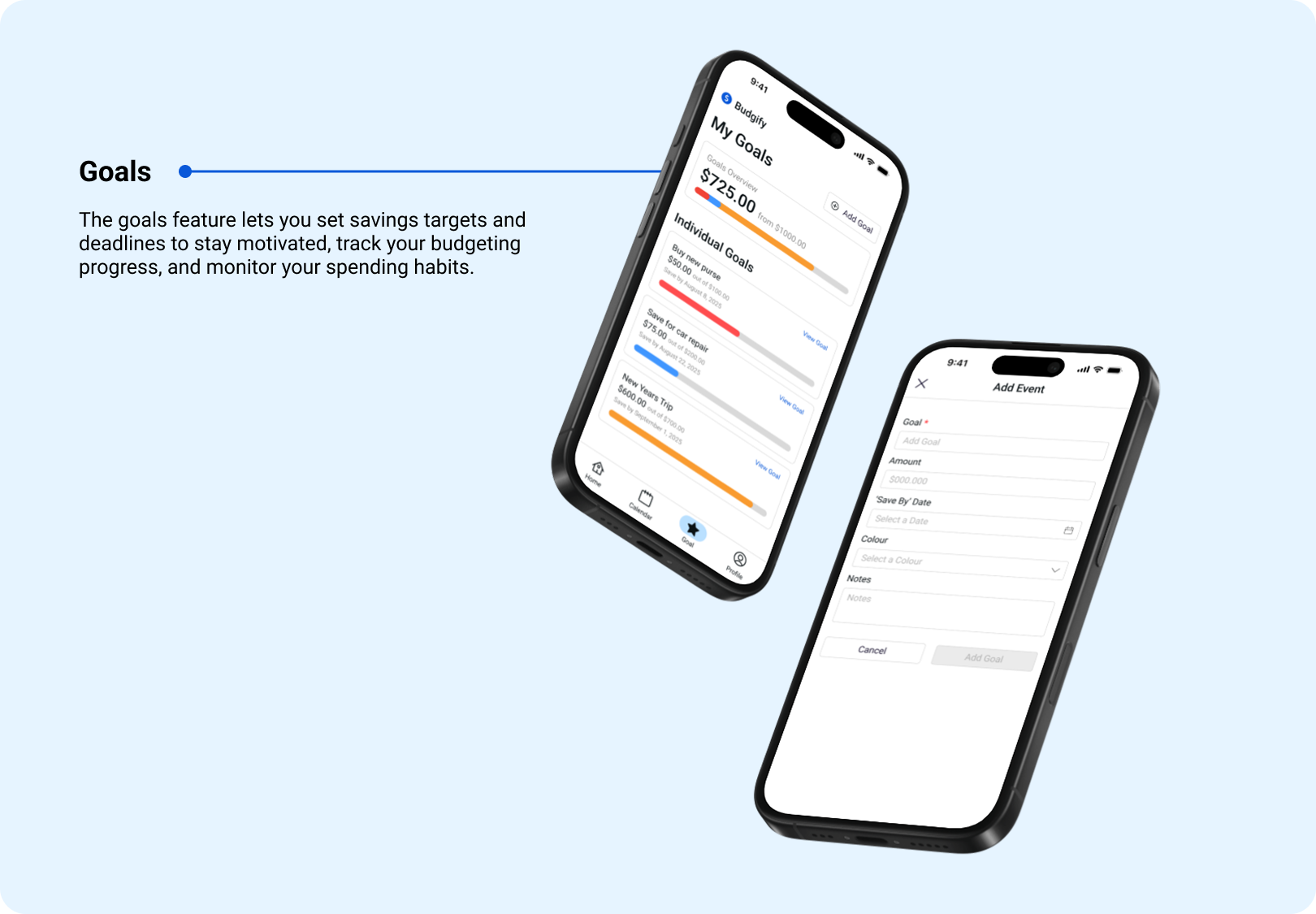

Goal Setting

Allow users to set and update goals regarding their finances. Setting goals allows users to remain accountable and see their progress.

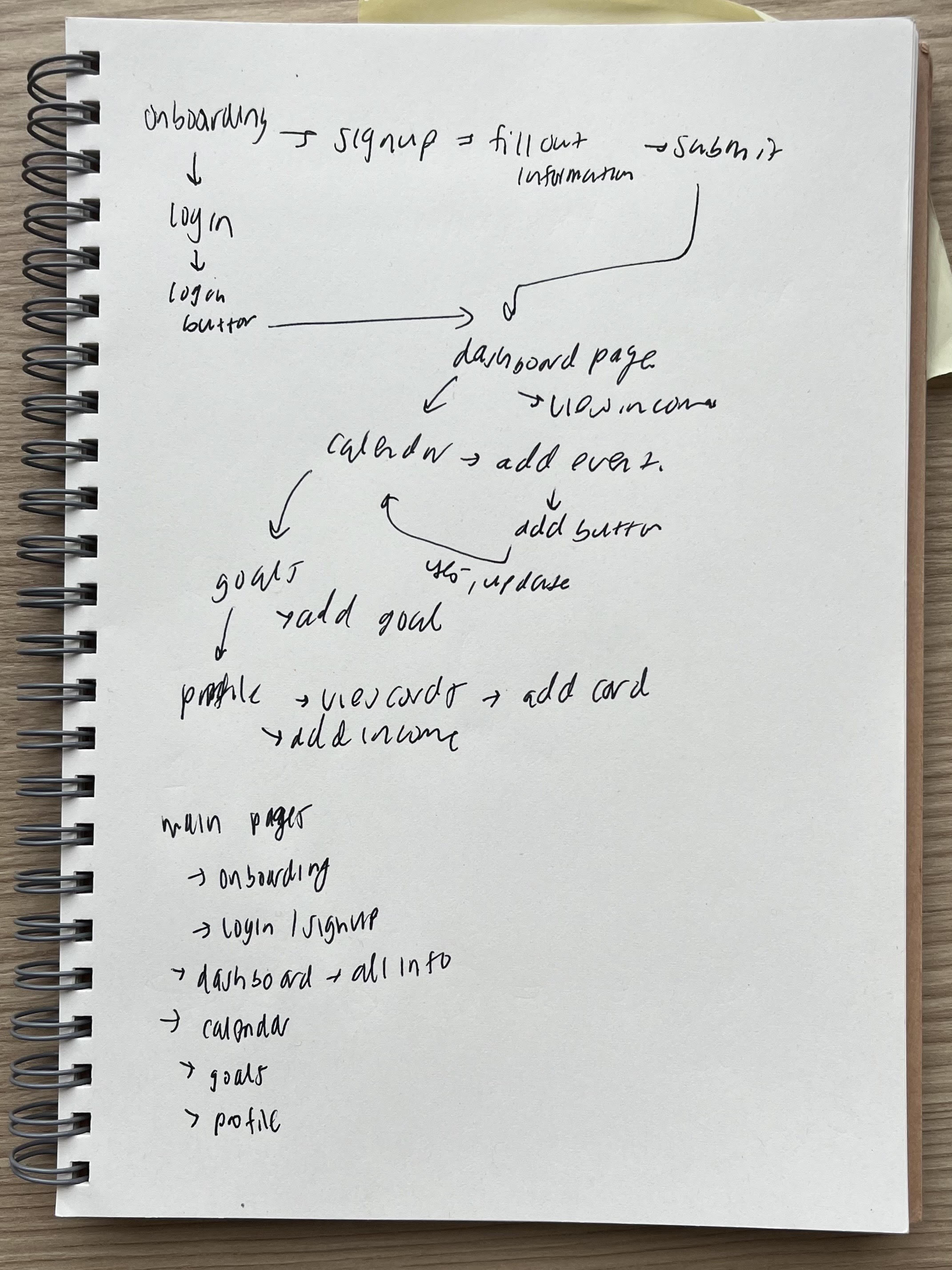

Flow Sketch

A quick sketch done to understand how the pages will connect and what can be done with each page.

Design

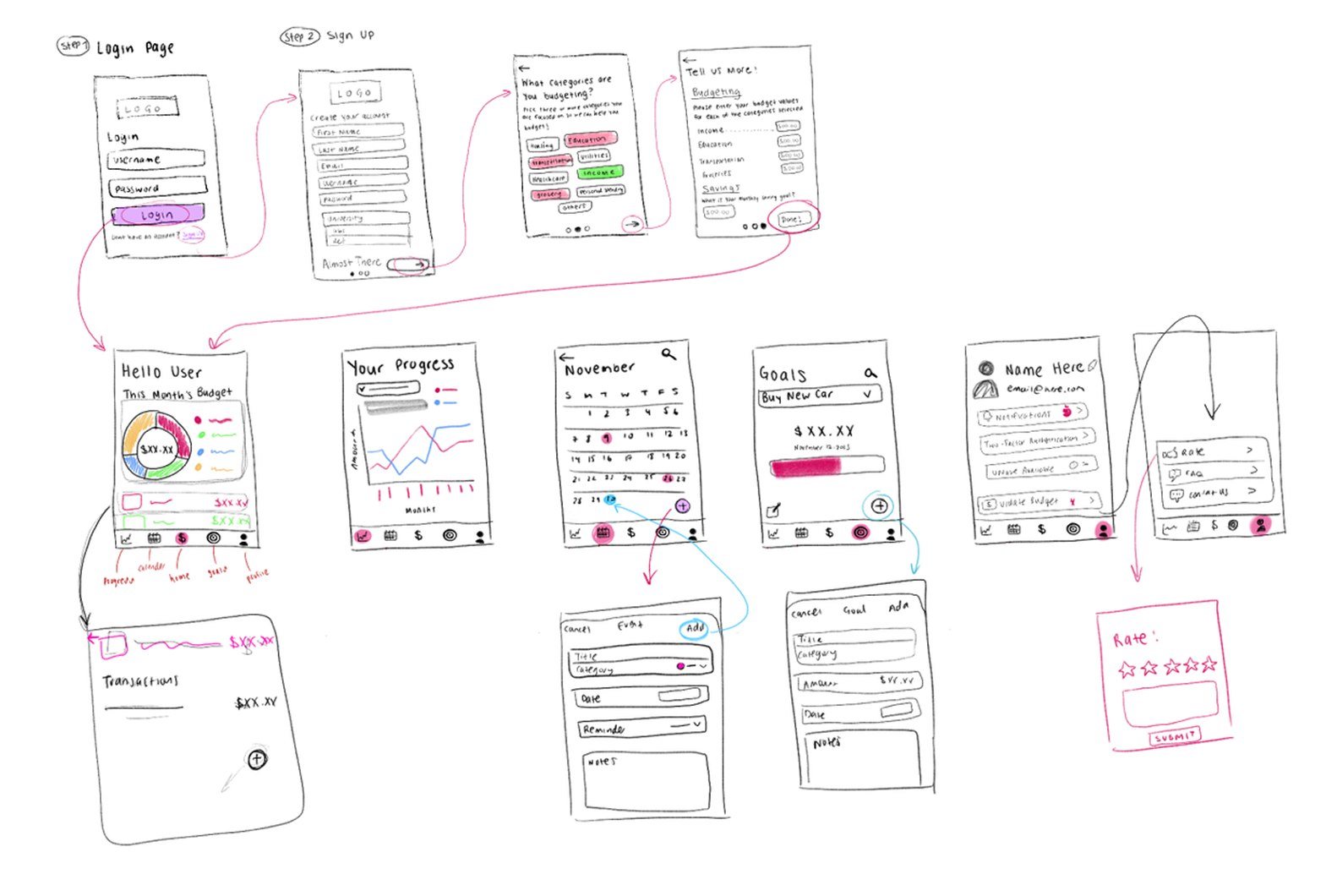

Wireframes

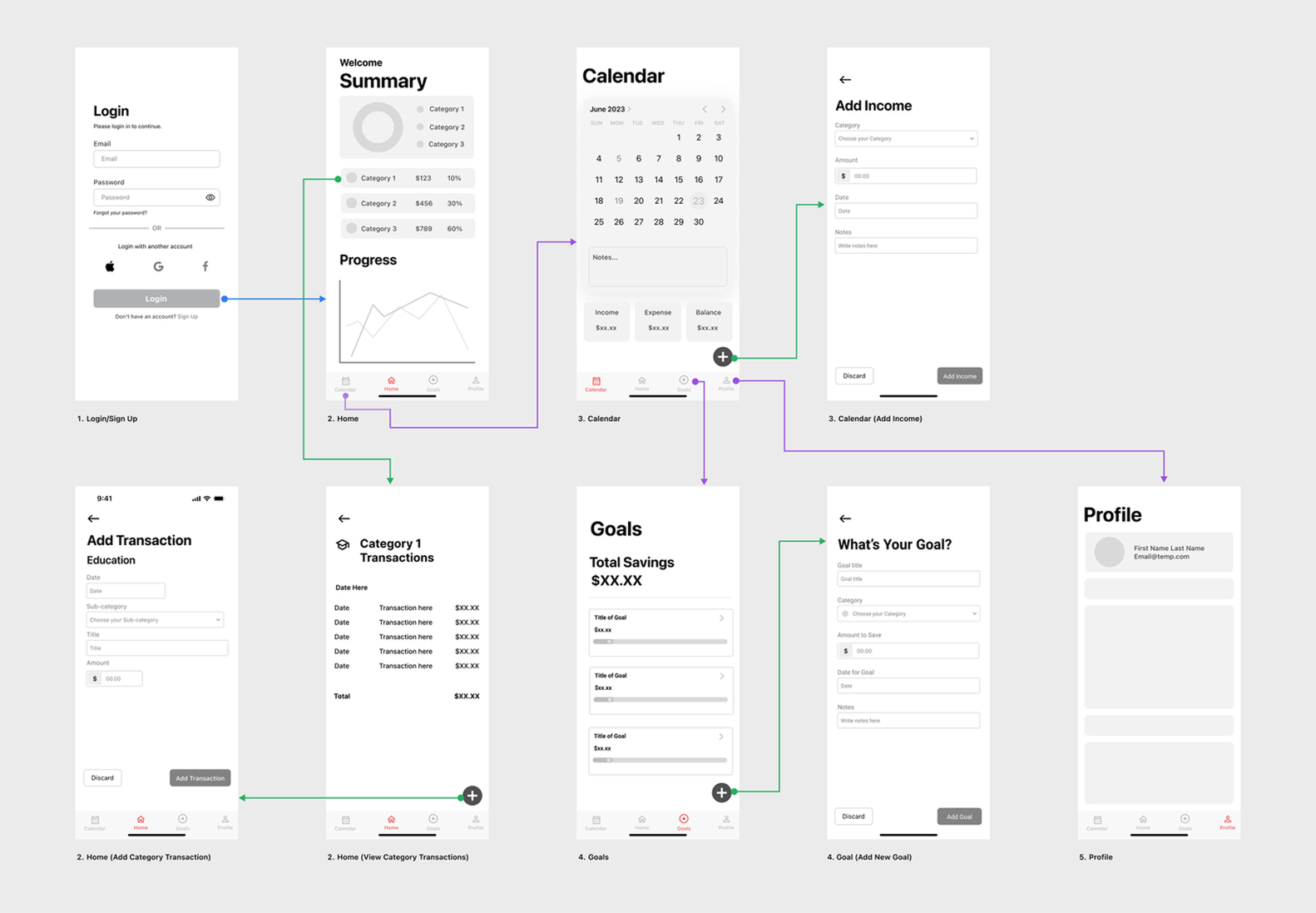

Based on the solutions and the features that we wanted to include in our application, we came up with rough wireframe sketches. These sketches laid out the pages and the components on each page. We also wanted to understand the flow between the pages and how users would interact from one page to another.

Low Fidelity Prototypes

Once we had a rough idea of the pages we wanted to design, we went into Figma and made a low-fidelity design based off of the sketches.

The following prototypes also demonstrate how the user will navigate between the pages.

Unfortunately, due to limited time, our team was not able to collect user feedback at this stage. I hope to collect user feedback for future projects at the respective stages of the case study.

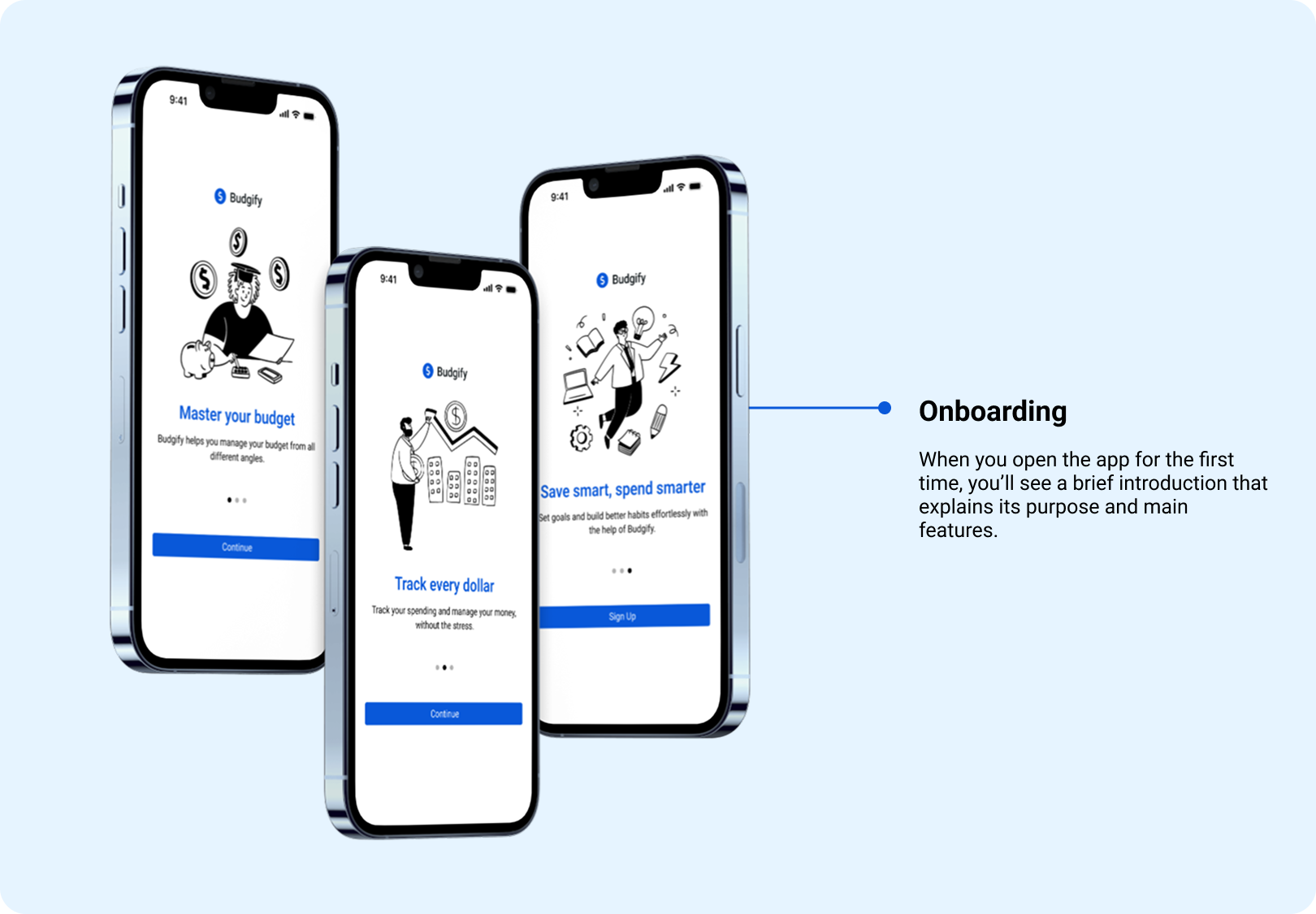

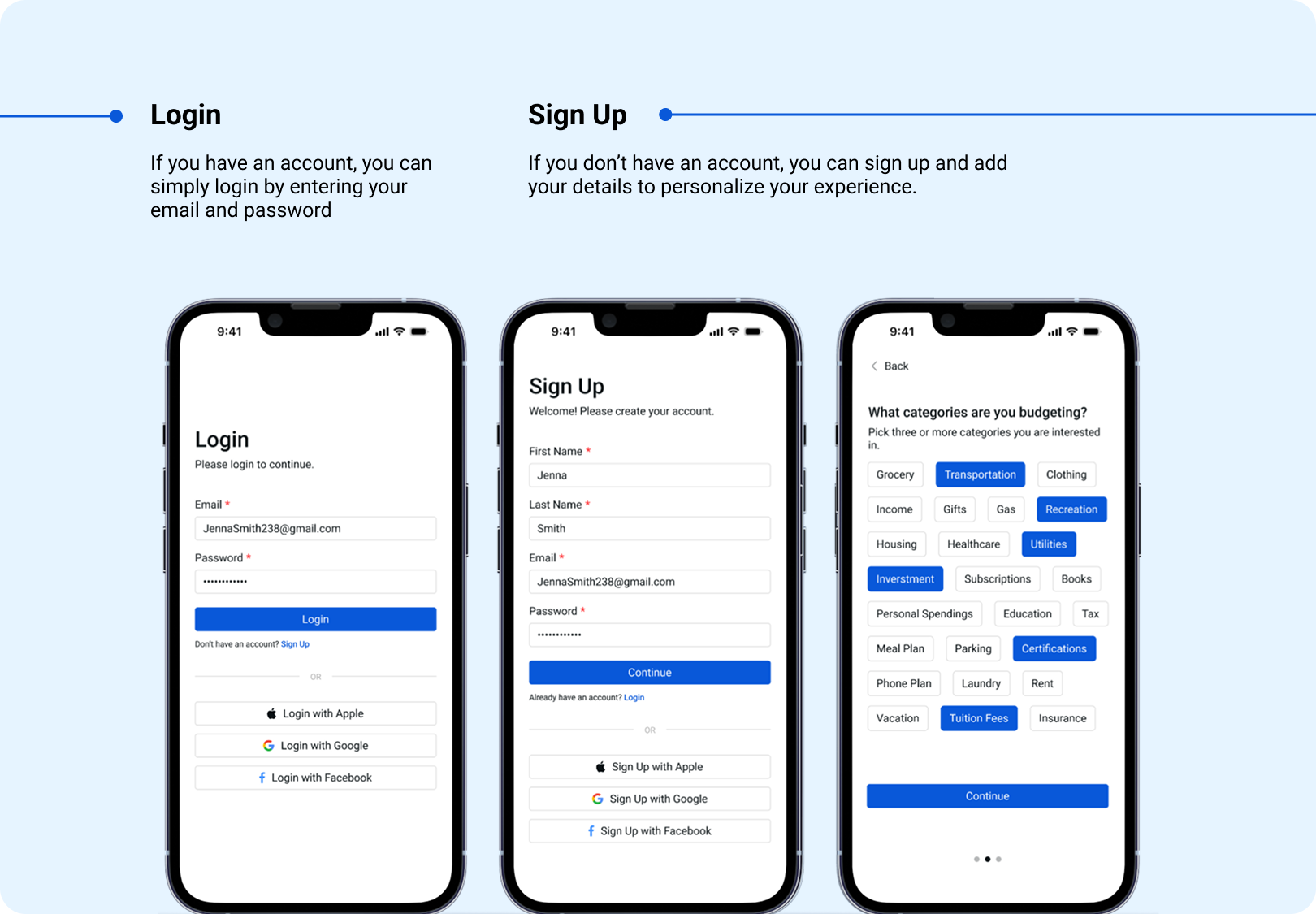

High Fidelity Mockups

Mockups

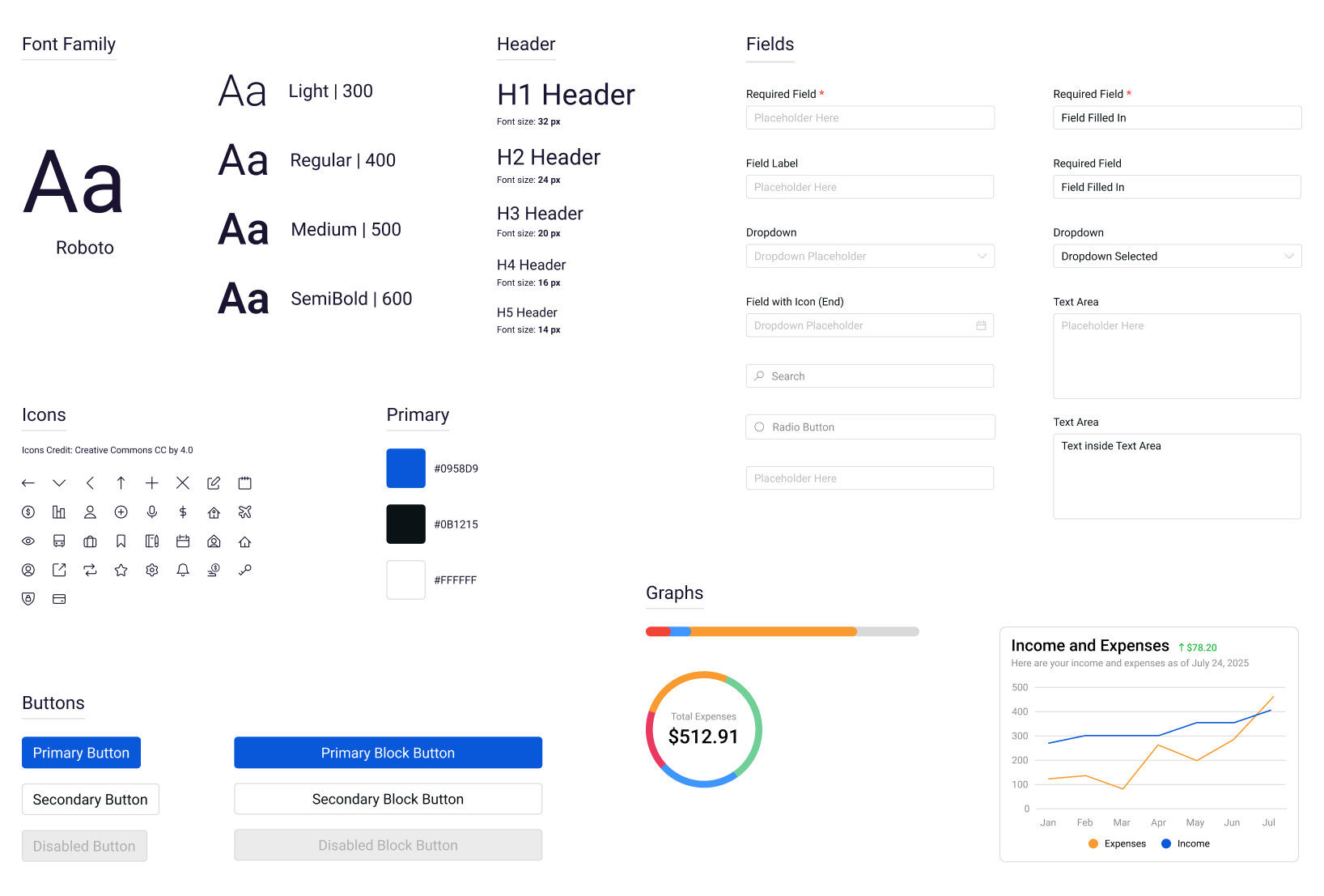

Design System & Components

The following is the design system for the application. We wanted to create a design system that made it easier for users to use the application from a visual perspective.

Click here to view all of the components.

Next Steps

Gather User Feedback

We would run usability testing sessions with students to validate our designs. This would focus on key tasks such as adding expenses, setting goals, and navigating the budget calendar. Feedback from these sessions would help us refine both the wireframes and high-fidelity prototypes.

Add Motivation and Gamification

We would explore adding light gamification elements to keep students motivated. Examples include progress bars, saving streaks, or milestone badges. We would also design subtle nudges such as “You’re halfway to your monthly goal” to encourage consistent engagement.

Add Impact Metrics

We would identify measurable outcomes to track the app’s success. Examples include reducing late fees, improving awareness of budgets, or increasing student savings over time. Even as projections, these metrics would provide a way to measure impact.

❤️ Thank you

Thank you for viewing my case study!

Click here to view the Figma file with the high fidelity design.

Click here if you have any questions or would like to further discuss this case study.